luza studios/E+ by means of Getty Pictures

Previous December, we highlighted Micron (NYSE: NASDAQ:MU) was getting highly-priced, as the company’s share selling price moved in direction of $100 / share. In April, at $75 / share, we wrote buyers should start out to take a glimpse, stating “…implying a $54-61 per share range to get started investing”. As we will see via this write-up, with the modern value weak spot, we endorse traders get started investing in Micron.

Micron Current market Prospect

There’s no denying that Micron operates in a enormous and modernizing sector.

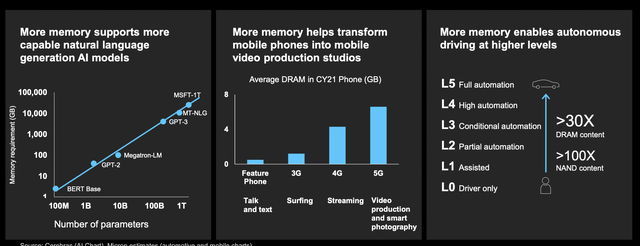

Global Memory Consumption – Micron Trader Presentation

Memory usage throughout just about every single use situation is increasing exponentially. Organic language designs in AI are employing terabytes of memory to aid their operations. Cell phones needing to guidance 5G and other intense operations and details centered activities are looking at DRAM averages boost appreciably.

Self driving autos call for 100s of periods as substantially compute as your conventional automobile which by now has a sizeable number of electronics. DRAM and NAND little bit need is expected to mature by the double-digits % on a yearly basis, and from a profits point of view, the DRAM+NAND industry earnings is anticipated to more than double from 2021-2030.

Field Consolidation

At the exact time, DRAM, an marketplace whose money demands usually routinely brought on bankruptcies, has found significant consolidation forming an oligopoly of types.

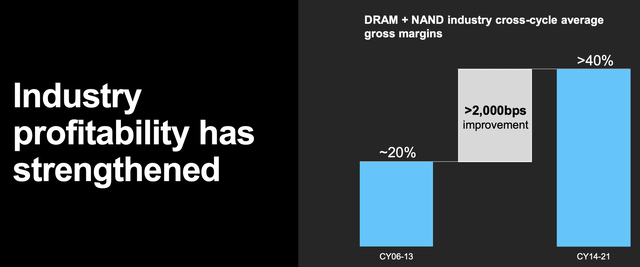

DRAM+NAND Margins – Micron Investor Presentation

Cross-cycle ordinary gross margins for the field have doubled for the CY2014-2021 time period compared to the place they have been in the CY2006-2013 time period. In the same time body, wafer fab tools devote as a % of EBITDA has been reduce in 50 % just about to new amounts of approximately 30%. That has enabled businesses to boost their balance sheets noticeably.

In genuine oligopolist vogue, the several remaining memory producers don’t want this to transform. Micron has guided to go on escalating provide in line with need advancement versus attempting to obtain market place share, and its competitors are lining up. These field-large enhancements in a expanding marketplace are a bedrock of the thesis for a extended-time period expense in Micron.

Micron Funds Prerequisites

Micron currently has a hard to replicate portfolio of property. The corporation has believed the alternative price of its property at about $100 billion with 50,000 patents to safeguard these remarkable belongings.

Micron Investor Presentation

Having said that, ramping to new solutions, increasing know-how, and scaling little bit expansion are all highly-priced. The organization expects that to sustain source development in line with sector need (i.e. keep its market share) it will have to commit $15 billion in funds expenses annually. That is significant for a enterprise with $30 billion in TTM income.

Having said that, it is well worth noting by the conclusion of the ten years, that really should develop toward $60 billion specified the enterprise maintains the same market place share in the developing current market. That usually means likely forward, the firm will go on to pay back the greatest share of its earnings in the direction of cash expenses, proscribing its theoretical cash movement.

On the bright side, the oligopolistic nature of the memory sector means the enterprise is possible to accomplish its aim of preserving current market share and the accompanying income.

Micron Shareholder Return Prospective

With small debt, we anticipate Micron to be equipped to make modest and responsible shareholder returns around the coming a long time. The organization a short while ago declared an raise in its dividend towards approximately 1%, forming the foundation of its dollars move.

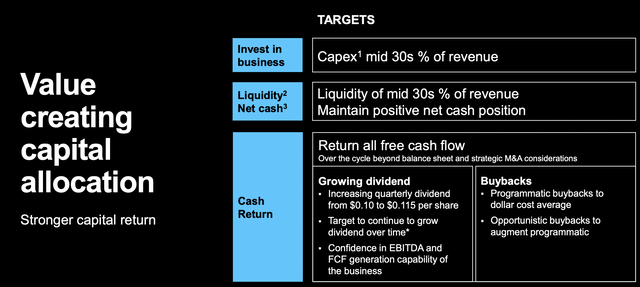

Micron Investor Presentation

Micron has presented steering that allows us predict the firm’s shareholder returns. The firm expects $150 billion in capital paying out in excess of the subsequent 10 years with a target for that to be ~35% of profits. That implies about $430 billion in profits around the up coming ten years, though like capex, we be expecting it to be again weighted.

The company

has also declared a concentrate on for a >10% FCF produce as a % of earnings. That implies that on the reduced end the enterprise must see (as an common) around $4.5 billion in FCF yearly, implying a approximately 8% FCF produce across the decade. That may appear to be only like industry average, having said that we assume you can find two other rewards right here.

Very first the company will go on developing. It would not complete the decade as a stagnant business without end doomed to return 8% in FCF, but it’ll see that number continue on ticking up in the very long run. Second, the corporation, especially as present-day ranges, we expect to be aggressively shopping for again shares. The significantly less shares exceptional early on the higher the conclude of the ten years returns are.

Existing levels symbolize approximately where we suggest to commence investing in Micron, and we like it at latest amounts or reduced.

Thesis Danger

The largest hazard to our thesis is the volatility of the memory markets. Even with reduce competitiveness, and considerably less of a establish at all prices mentality, the business nonetheless remains capitally intense with commodity-like pricing as need differs. Fluctuating costs could place strong constraints on the firm’s skill to drive continued shareholder returns.

Conclusion

Micron has viewed its share rate experience, on the other hand, the corporation is at last positioned at what we look at as fair worth, which will empower it to continue providing shareholder returns. The business is a purchase at these degrees and a sturdy acquire if selling prices drop likely forward, with the ability to push significant one-digit shareholder returns.

The corporation expects to proceed preserving its current market strength, with sizeable cash financial commitment. The marketplace is a volatile market place but the increased consolidation and bankruptcies in prior a long time, signifies we be expecting the increase and bust cycles to taper. Micron by itself isn’t chasing shareholder returns.

We advise investing in the company as a steady dependable expense on the foundation of its high-single digit returns, and capacity to benefit from that funds to crank out extra prolonged-expression shareholder rewards in a developing industry.

More Stories

What Needs to Be Done to Accelerate the Implementation – Grape Up

The Benefits of Having a Tech Team in Your Business

Stellantis to restructure European dealer network in July 2023 • TechCrunch