Micron Technological know-how Vs. Marvell Technological innovation: Which Stock Is The Improved Obtain?

DNY59/E+ through Getty Illustrations or photos

Short article Thesis

Semiconductor stocks have just lately come below a ton of tension because of to recession anxieties. I do imagine that these anxieties are somewhat overblown and that the the latest share cost pullbacks present for appealing entry points in some semiconductor shares. Because of to reader interest in this issue, we will discover Micron Technology, Inc. (NASDAQ:MU) and Marvell Know-how, Inc. (NASDAQ:MRVL) to see which of these semiconductor stocks may well be the better buy at latest costs.

How Are Micron Know-how And Marvell Technological know-how Unique?

Each corporations are semiconductor businesses, but there are however crucial differences. Although Micron is a memory firm that generally manufactures DRAM memory, Marvell is lively in other areas these types of as Ethernet options, application processors, and storage controllers. Micron is the substantially greater organization, remaining valued at $59 billion right now, whereas Marvell is valued at $39 billion ideal now. Micron operates its personal manufacturing services, whereas Marvell Technology is a fabless business. Each of these methods have their benefits. Micron, thanks to working its own factories, is considerably less dependent on other firms and can extract a lot more dollars throughout the benefit chain. On the other hand, Marvell’s fabless enterprise product enables it to function with incredibly small funds expenditure budgets, which signifies that a increased part of its working dollars flows can be turned into cost-free dollars stream that can profit traders. Micron’s greater dimensions makes it possible for it to run its personal factories, while Marvell’s more compact dimension and lessen revenue predestine the business to operate as a fabless business.

MU And MRVL Stock Crucial Metrics

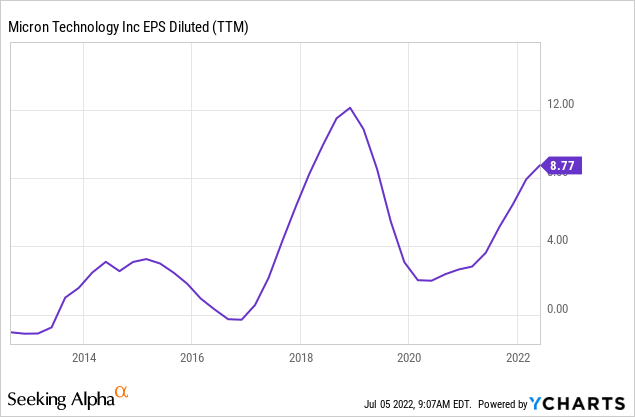

The semiconductor market as a whole can be explained as a expansion industry. Know-how is having an at any time far more essential section in our day-to-day lives, both of those when it comes to hobbies/recreation as perfectly as when it will come to undertaking business enterprise. Not all semiconductor market segments are expanding at identical prices, however, and income expansion can be diverse than enterprise expansion. That is specially the case in commoditized segments of the business, such as the DRAM space Micron is active in. Right now, owing to slowing need and weaker pricing, Micron is experiencing a downturn. The company’s not long ago-announced quarterly success presentation provided steering that was considerably weaker than envisioned and that suggests that the present quarter will be way weaker than the prior one. Whilst Micron gained $2.60 in Q3, recent Q4 assistance indicates earnings for every share of $1.60, a decrease of close to 40%. That currently being mentioned, even $1.60 in quarterly earnings continue to receives us to more than $6 in yearly profit per share, which is nevertheless quite great for a company trading in the small $50s.

These ups and downs in profitability are to be predicted from Micron, since its solutions are at least to some degree commoditized and since its business enterprise design of operating its personal fabs does not enable it to deliver down expenses immediately in a downturn. Nonetheless, in excess of time the cyclicality has improved. Even at the latest base, Micron was even now very lucrative, which experienced not been the situation in prior cycles, when Micron quite often noted web losses at the cycle trough. This enhancement can be spelled out by consolidation in the market that will make the oligopoly act more rationally when it comes to setting up out capacity. On leading of that, Micron has been hoping to transfer into much less commoditized areas the place it is significantly less dependent on pricing for overall memory solutions, which allows with its profitability throughout cyclical downturns (that are primarily selling price-driven, not quantity-pushed).

Marvell Engineering, on the other hand, does not knowledge very similar cyclicality, but that is reflected in its way better valuation. Marvell’s current progress record is practically best:

Looking for Alpha

The business grew both equally its revenue as well as its profits quite regularly over the final couple of yrs. Even superior, the enterprise also managed to beat estimates throughout nearly each individual quarter, with not a one earnings for every share pass up about the previous 3 yrs, and just one revenue overlook in that period of time.

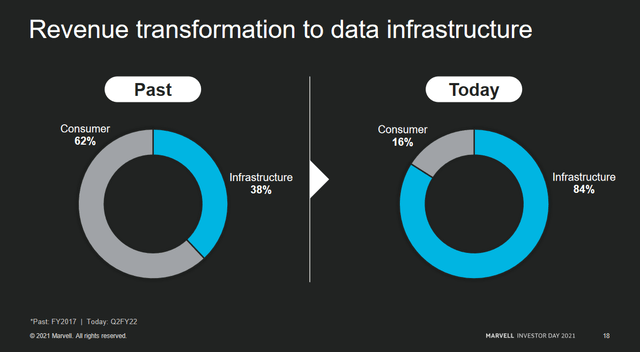

Marvell Know-how is a far more specialized business that is providing to a significantly less commoditized sector. Its product or service combine has shifted toward cloud computing in new yrs, and infrastructure profits now makes up more than 80% of Marvell’s earnings as can be viewed in the following slide:

Marvell presentation

With reduced dependence on consumer items, a slowdown in Laptop product sales, for case in point, does not hurt Marvell

to the similar degree it hurts Micron. Cloud computing companies may well minimize their expending on new products through a substantial financial downturn, but I do imagine that it is unlikely that Amazon (AMZN), Alphabet (GOOG) (GOOGL), Microsoft (MSFT), and other cloud leaders will shrink their investments also significantly. Over-all, this is nevertheless a major development marketplace as a lot more and a lot more knowledge gets gathered and demands to be processed and stored, therefore the outlook for more infrastructure investing is beneficial – which should be optimistic for Marvell. The firm has recognized automobiles as a important progress industry, forecasting that its market opportunity in this space will expand at a high-20%+ tempo above the subsequent couple of many years. With autonomous driving becoming much more and much more of a development and EVs typically necessitating way more chips than similar ICE-driven vehicles, there are good factors to think that Marvell could be suitable in figuring out this current market as a significant-progress possibility.

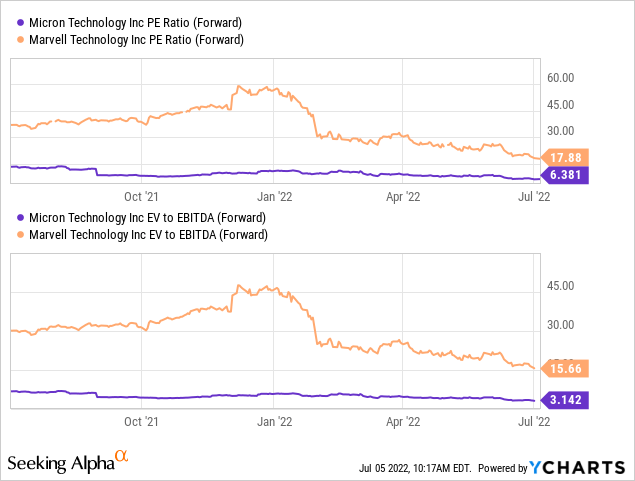

Micron’s small business product is additional cyclical and the enterprise will probably make significantly less development, general, in the coming several years. Marvell is forecasted to grow its earnings for each share by 49% this yr and by one more 27% up coming calendar year, according to present-day analyst estimates as proven here on Looking for Alpha. On the other aspect, Micron is forecasted to expand its earnings for each share by 41% this yr, but analysts expect that Micron’s earnings for each share will drop by 18% following calendar year. On a two-12 months stacked foundation, Marvell’s progress fee is therefore 38%, whilst Micron’s development amount is 8% in the identical time frame. Both equally from a advancement perspective as well as from a recession-resilience/cyclicality perspective, Marvell is thus the better decision. But that does not element in valuation nevertheless, which is an significant concept to contemplate when producing financial commitment decisions. On that entrance, Micron outclasses Marvell:

Micron trades at approximately just one-3rd of Marvell’s earnings multiple, and approximately one particular-fifth of Marvell’s EV/EBITDA many. Since Micron has a way larger sized asset base, depreciation rates are considerably greater, and given that those people are included back when calculating EBITDA, its EBITDA towers in excess of Marvell’s EBITDA. This is partly well balanced out by the reality that Micron has to devote substantially extra on funds expenses when compared to Marvell with its fabless model, hence a discounted on the EV/EBITDA ratio is warranted. Nevertheless, the lower price is so enormous, equally on an EV/EBITDA and selling price-to-earnings basis, that Micron obviously wins out on the valuation front.

When it will come to shareholder returns, each providers shell out a fairly equivalent dividend with a produce of close to .5%. Which is not fascinating, but Micron buys back shares at a significant rate on major of that. About the final 12 months, MU has bought again around $3 billion worth of shares, equivalent to all-around 5% of its industry capitalization. Thanks to a potent equilibrium sheet, investors can hope that Micron will proceed to return surplus cash to them by way of buybacks over time. Marvell, on the other hand, has not made available meaningful buybacks in the current earlier, which is why its shareholder returns are considerably from remarkable. But due to much better business enterprise growth momentum, which is not a catastrophe.

What Is The Long term Outlook For MU And MRVL Inventory?

Both of those organizations have pulled again massively this 12 months. Micron is down 43% so far this calendar year, whilst Marvell dropped by an even greater 53%. This is terrible news for previous traders that have witnessed their financial investment benefit shrink noticeably, but superior information for those trying to find to deploy new money. At the present valuation, both equally Micron and Marvell glimpse affordable. Micron is cyclical and not offering overly steady progress, but still has a constructive extensive-phrase outlook as memory demand from customers will expand more than the decades. It is buying and selling at an ultra-reduced valuation of just 6x this year’s earnings and can buy back close to 5% of its shares at the current tempo. In the extended operate, i.e. in excess of a number of many years, that mixture really should direct to powerful complete returns.

Marvell is way more expensive, but its 18x earnings several would seem warranted centered on the fact that the company is rising extremely rapid and that its expansion is not incredibly cyclical thanks to lower shopper publicity. Cloud computing will get at any time a lot more significant, and with exposure to development marketplaces such as auto, Marvell is poised to encounter speedy company development.

Is MRVL Or MU Stock The Superior Buy?

Each corporations have benefit at present costs, I consider. Whether or not one favors Micron or Marvell relies upon on one’s investment style. Micron is a clear price decide on, whereas Marvell is extra of a growth-at-a-affordable-price tag choice. In the in close proximity to phrase, fairness market place difficulties could end result in declining share charges for each firms. But in the lengthy operate, both equally companies need to see their shares climb from current amounts, which is why neither firm is a lousy obtain, I think.