-

Investors should really buy technological innovation shares after their months lengthy offer-off entered bear marketplace territory, according to Fundstrat.

-

“Investors deem Technological innovation ‘done’ but we imagine Technological know-how demand from customers will speed up [over the] following couple of a long time.”

-

These are the a few motives why Fundstrat’s Tom Lee thinks buyers really should get know-how shares.

Technological know-how shares went from most loved in yrs of the COVID-19 pandemic to now the most heavily bought, dependent on the fundamental sector functionality of the inventory sector.

The Nasdaq 100 fell into a bear market in 2022, dropping about 30% from its document large, which is a more substantial decline than the index knowledgeable in March 2020. A mixture of lofty valuations, a pull forward in demand from customers, and increasing desire premiums helped fuel the months-prolonged drop in the sector, amid other elements.

But buyers really should acquire edge of the drop and start off buying the tech sector, in accordance to a Monday observe from Fundstrat’s Tom Lee. “Buyers deem Technology ‘done’ but we believe Technology need will accelerate [over the] following couple of many years,” Lee mentioned.

Lee presented a few large good reasons why it nevertheless can make feeling to individual the tech sector for the lengthy-time period, even as extra standard financial system sectors like energy proceed to soar.

1. “Technological innovation desire will speed up as providers seek to offset labor scarcity.”

“World wide labor source is shrinking compared to need. Our 2017 evaluation exhibits the world is getting into a period of time of labor scarcity. Development rate of staff age 16-64 is trailing total populace expansion, setting up in 2018. This reverses worker surplus in spot given that 1973,” Lee discussed.

The world labor scarcity is a prolonged-time period possibility for technological innovation and automation to action up and fill the gap, in accordance to Lee.

“2022 is accelerating the use scenario and ROI for automation. If minimum wages are rising, [and] businesses are increasing beginning salaries, this raises the ROI and justification for labor replacement by means of automation. This is an obvious desire accelerator for Technology — aka $QQQ Nasdaq 100,” Lee stated.

2. “Technologies valuations are reduced than the 2003 trough.”

The Nasdaq’s value-to-earnings ratio currently is lessen now than it was at the depths of its dot-com unwind, when the Nasdaq 100 declined by almost 80% from its 2000 peak, in accordance to Lee. “Nasdaq 100 is less expensive right now than at the absolute 70-yr lower of 2003. Yup, marketplaces crashed worse than dot-com,” Lee explained.

“If anything, this need to affirm why the threat/reward in FAANG is interesting. Even anecdotally, the negative information seems priced in,” Lee mentioned.

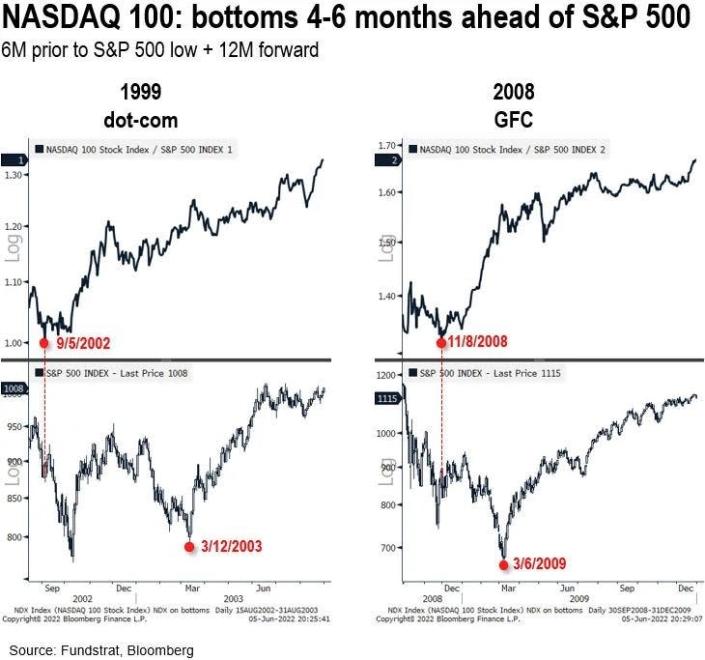

3. “Technological innovation has led off every single main bottom.”

“What outperformed following dot-com crash? Technologies stocks… yup. The desire story for Technologies is most likely set to speed up in next few decades, and just about every significant sector bottom sees Nasdaq bottom 4-6 months forward,” Lee stated.

Just after the each dot-com bubble burst and the Great Monetary Crisis, the Nasdaq outperformed other indices around the upcoming five years, according to Lee. “This chart says it all… we assume FAANG guide publish expansion scare,” Lee concluded.

Read the unique post on Small business Insider

More Stories

Best Free Android Emulators for Windows 7, 8.1, 10 PC in 2021

What is Bitly & How Does It Work? –

Black Friday deal: Grab the second-gen Apple TV 4K for just $80