Micron: Deteriorating Gross Margin Factors To Share Cost Downside (NASDAQ:MU)

Adam Smigielski/E+ through Getty Images

In my short article on Micron Technology (NASDAQ:MU) published on May 3, I introduced a thesis that the macro backdrop is onerous for memory demand and therefore MU’s organization. I also pointed out that for Micron, gross margin “GM” is an great metric to measure source-demand from customers stability, and hence the overall health of the business. Micron’s GM has plateaued for four quarters, indicating that GM could decrease quickly. The selling price of MU’s shares was at $71.26 at the time of publication of that report. The price tag has declined to $53.65 at the near on July 1, symbolizing a decrease of about 25%. This is when compared to a drop of about 8.4% in the S&P 500 more than the similar time span. In this article, I will deliver an update to the thesis. In particular, the macro outlook has worsened, and I expect MU’s GM, profitability, and share price to keep on to decline.

Micron’s Business enterprise Is In A Down Cycle – Gross Margin, Profitability, And Share Selling price Will Probable Continue on To Decline

Micron is a great company. It is extremely competitive with the other semiconductor memory suppliers of the earth. Its harmony sheet is strong, and it generates important absolutely free cash move. It has been cutting down its value structure, creating it more profitable by means of a cycle. Micron and its friends have been additional rational in their capex financial commitment. I glimpse forward to shopping for MU shares sometime, but these days I am brief into this down cycle.

It is my impression that in spite of the significant-tech mother nature of the producing procedure, memory is a commodity, and the small business is cyclical. Profitability is pushed by provide need balance. As a outcome, Micron trades like a cyclical commodity stock with minimal PE ratios. That’s why, in get to revenue from investing in MU stock, a person must trade it like a cyclical commodity company, advertising shut to the best and purchasing near to the bottom.

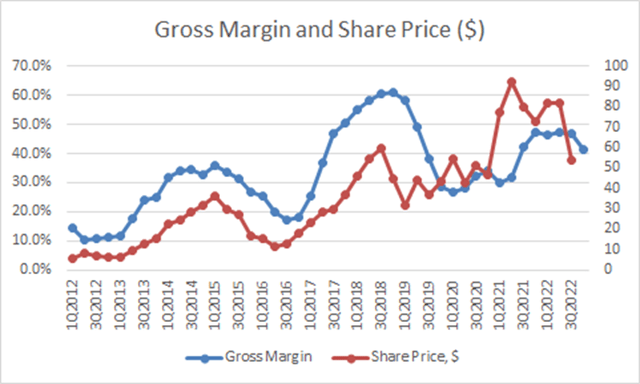

I have uncovered that MU’s GM is the greatest indicator to foretell the top rated and the base of the cycle. A chart of MU’s historic GM and share rate is shown in Determine 1. The previous GM details position is management’s guidance for F4Q, which is 41.5% at the mid-stage.

Figure 1: Micron’s historic GM and price. Be aware: the selling price in Determine 1 is the closing rate the day just after earnings print. (Firm releases and SA info base)

Figure 1 exhibits that traditionally, MU’s price peaked and then declined following the GM rolled more than and declined and bottomed and then improved immediately after the GM bottomed out and improved. Nevertheless, in the recent cycle, the GM has plateaued for 4 quarters and traders have been selling forward of the GM decrease, probable for the reason that of the weakening macro outlook. In retrospect, the plateauing of the GM was possible an indication that regardless of constant price tag reduction, MU is losing pricing electrical power and has to move together most of its charge savings to its buyers in purchase to retain industry share. This would have been an early sign of slackening desire.

Micron’s Buyer Experiencing Business enterprise Is Down, And Cloud, Organization And Automobile Companies Will Likely Roll In excess of Shortly

This down cycle is driven by the macro-induced demand destruction. This is not dropped on administration and the analysts. The words and phrases “macro” and “macroeconomics” appeared no less than 10 times in the F3Q2022CC. The macro headwinds are front and center in everyone’s issue.

Micron reported that the customer dealing with firms (smartphone and shopper Computer) are deteriorating rapidly for the duration of F3Q. This is one thing that I have pointed out in my Might 3 short article. Micron also documented that the data centre, enterprise, and auto organization are holding up. For the duration of the Q&A session, analysts expressed their worries for the robustness of the knowledge center enterprise as company CIOs are anxious with the macro-outlook and are pulling again on their funds. Analysts also pointed out that Chinese facts centers have presently pulled again their expending. Additional, memory inventory is elevated in the knowledge centre source chain, even better than before the pandemic. Whilst management did not give any concrete responses, it is likely that the analysts’ worries are simply just main indicators of a downturn in the knowledge heart organization.

Equally, when business shoppers tighten their spending budget, the company customer business enterprise will most likely decline. The automobile enterprise is constantly quite delicate to the financial system. With the macro backdrop deteriorating rapidly, I will not be shocked that the auto organization will roll in excess of shortly. Therefore, it is probably that all of MU’s business enterprise segments will decrease in the next many quarters, more impacting income, GM, profitability, and share price.

Administration has indicated that market place visibility is worsening. This can be found also in the decreased income and GM advice for F4Q and broader bands for the guidance. Profits steerage is at $7.2 billion compared to analysts’ consensus of $9.02 billion, a big miss. The profits steerage band is widened from a typical +/- $200 million to +/- $400 million. Likewise, the GM steerage signifies a fall of 520 foundation position at the mid-place and the band is widened from a typical +/- 1% to +/-1.5%. Further, management refused to forecast when this cycle will base. Frankly, I do not think that they know mainly because this down cycle is macro-driven and they, like most folks, have very limited visibility on the trajectory of the macro.

I give management credit history for accomplishing

factors that are inside their regulate. Administration will slash operating charges and capex. They will reduce wafer front stop utilization in 2023. Nonetheless, provided the prolonged direct time in the manufacturing cycle and the rapidly declining need, management expects stock, now at 108 days of income, to explode by maybe as considerably as 20 additional times of sales. This will possible even more exacerbate the downturn in GM because of to probable compose-downs, decreased utilization of wafer front conclusion, and larger COGS carried in stock. As a result, I count on GM to decline additional outside of F4Q, taking MU’s share cost down with it alongside the way.

Gross Margin Is Probably The Greatest Indicator To Observe For The Bottom

An investor’s organic query is: when will the share cost base? I do not know, but I will let my GM indicator guideline me. I consider it is the finest indicator for predicting the turning of the cycle and will view the two the GM and the price of decline of the GM. When the amount of decline moderates, it might be time to near my small positions and go lengthy.

Some visitors have commented in my May perhaps 3 posting that the very low PE ratio of MU shares will deliver assistance for its share selling price. Regretably, earnings will possible decrease in a down cycle, producing the PE ratio to maximize. Therefore, I believe that for most cyclical stocks like MU, the time to acquire is when PE is sky-high. The time to promote is when the PE is low. Nonetheless many others have proposed that MU’s guide value of about $43 per share might deliver a floor. Regrettably, cyclical firms could provide below e-book value in a down cycle. For this reason, an trader may well not find comfort in the e book price to give assist should really the macro get incredibly unappealing.

Macro Indicators Are Beneficial To Gauge The Bottom Of Micron Shares As Effectively

The macroeconomic headwinds impacting the around the globe financial state are properly recognized: Inflation, Fed tightening, war in Ukraine, Europe mired in a recession and electricity disaster, superior vitality price ranges, China’s economy is hurting thanks to the collapse of its property builders, COVID-19 lock-down, and insurance policies from its tech providers. These similar headwinds are impacting demand for MU’s memory products and solutions all over the world as perfectly.

Generally, a memory down cycle lasts about eight quarters. With the plateauing of the GM for four quarters, we may possibly be 1 to four quarters into this down cycle, relying on when you count as the commence of the down cycle. Therefore, there could be 4 or seven far more quarters to go right before this down cycle finishes. Having said that, given that this cycle is driven by the macro that will probably establish the duration of this cycle. For this reason, it pays to look at the macro indicators.

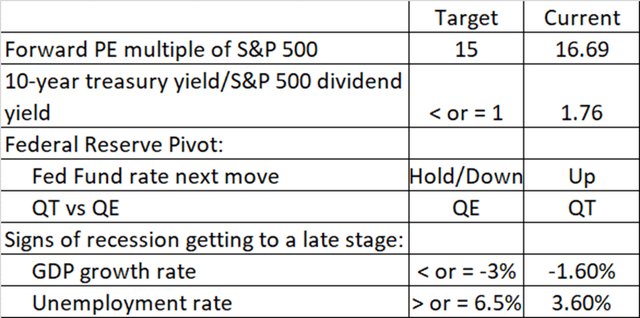

Proven in Figure 2 is a record of macro indicators that I intend to observe in conjunction with my GM indicator. I borrowed this checklist from Mr. David Rosenberg of Rosenberg Investigate. You can discover his function on this checklist of indicators right here between time stamps 1:36 and 4:32.

Figure 2: Checklist of macroeconomic indicators to view for market place bottom. (Rosenberg Research)

When my GM indicator demonstrates an inflection and when most of these indicators in Figure 2 have achieved or appear close to their respective goal values, then it would be time to close my short positions and go prolonged MU shares. Until eventually then, I will allow my small positions experience.

Looking at the indicators in Determine 2, one particular should not obtain too significantly ease and comfort in the forward PE of the S&P 500 remaining so near to the focus on worth. I believe that downward revision of forward earnings will come in earnest when 3Q earnings are described commencing in numerous weeks. Downward revision will very likely continue on for at the very least the upcoming six months, if not longer, therefore raising the forward PE ratio.

The latest 10-year treasury yield is 2.889% while the S&P 500 dividend generate is 1.64%. For the ratio of the two produce numbers to reach parity, possibly the treasury yield has to occur down a large amount or the S&P 500 has to drop a whole lot. Both will in all probability materialize as the economic downturn improvements. This just tells me that there is much draw back risk for MU share cost, even although it has previously declined by 45% from its peak of this cycle.

Pitfalls

In the previous cycle, traders have anticipated the peaking and bottoming of MU’s GM and acted accordingly in advance of the inflection points. Hence, there is a chance that traders could buy just before the base, thereby minimizing the return on my shorts and reducing the likely achieve of my potential longs. The economy may not worsen as much as I be expecting, and therefore MU’s shares could rebound rapidly. Micron, with its share selling price down considerably, may possibly catch the attention of a suitor, creating share value to soar. Promoting limited normally carries a chance of probably limitless decline. Purchasing a place alternative carries a chance of entire reduction of one’s funds.

Takeaway

Micron’s administration has guided GM and income to drop 520 bps and 16.7%, respectively, QoQ at the mid-place. A lot more importantly, the revenue steerage is 20% beneath analysts’ consensus, a huge miss out on! It is most likely that this down cycle will final perfectly into 2023, resulting in Micron’s share price tag to proceed to decrease. This down cycle is driven by macro headwinds. That’s why, it pays to enjoy my GM indicator for its inflection as properly as some macro indicators to information the timing of the closing of my shorts and to go extensive.