Micron Engineering Inc’s (NASDAQ:MU) quick percent of float has risen 5.7% since its past report. The company not long ago reported that it has 22.69 million shares sold brief, which is 2.04% of all common shares that are readily available for buying and selling. Based mostly on its investing quantity, it would just take traders 1.1 days to address their short positions on average.

Why Limited Fascination Issues

Limited desire is the variety of shares that have been sold quick but have not but been included or closed out. Limited marketing is when a trader sells shares of a corporation they do not have, with the hope that the cost will drop. Traders make dollars from quick advertising if the rate of the inventory falls and they drop if it rises.

Brief curiosity is crucial to track since it can act as an indicator of market place sentiment toward a certain stock. An maximize in quick fascination can signal that buyers have turn into much more bearish, while a reduce in limited curiosity can signal they have turn out to be additional bullish.

See Also: Checklist of the most shorted shares

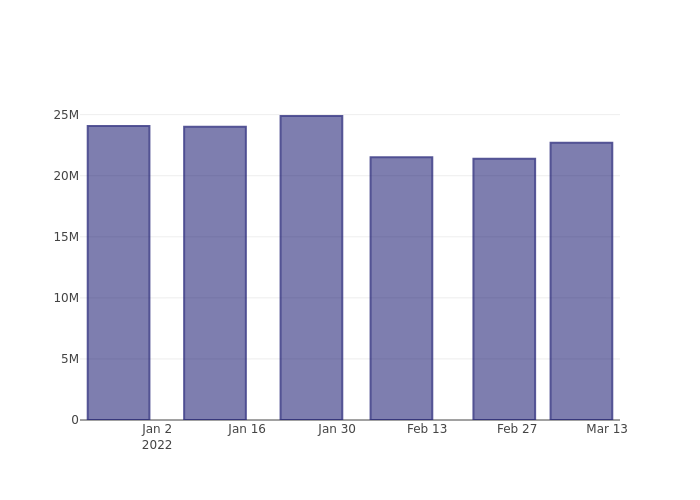

Micron Know-how Inc Short Desire Graph (3 Months)

As you can see from the chart previously mentioned the proportion of shares that are offered quick for Micron Technological know-how Inc has developed considering that its last report. This does not necessarily mean that the stock is heading to tumble in the in close proximity to-time period but traders really should be conscious that extra shares are remaining shorted.

Evaluating Micron Technological innovation Inc’s Small Fascination Versus Its Friends

Peer comparison is a well-known technique amongst analysts and investors for gauging how perfectly a business is doing. A firm’s peer is one more business that has equivalent qualities to it, this sort of as sector, measurement, age, and monetary construction. You can locate a company’s peer team by reading its 10-K, proxy submitting, or by doing your possess similarity investigation.

In accordance to Benzinga Professional, Micron Engineering Inc’s peer group regular for shorter desire as a proportion of float is 2.51%, which signifies the firm has significantly less brief desire than most of its peers.

Did you know that growing brief interest can essentially be bullish for a inventory? This post by Benzinga Money explains how you can gain from it..

This write-up was generated by Benzinga’s automated content motor and was reviewed by an editor.

More Stories

The Benefits of Having a Tech Team in Your Business

Stellantis to restructure European dealer network in July 2023 • TechCrunch

SOLID Design Principles in C# with helpful examples