Micron Technological innovation, Inc. (NASDAQ:MU) – Peering Into Micron Technology’s Recent Brief Fascination

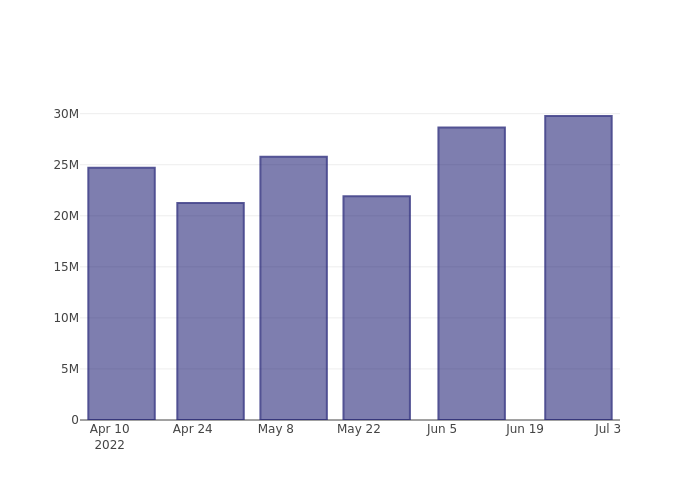

Micron Technology’s (NASDAQ:MU) brief percent of float has risen 3.88% considering that its final report. The enterprise a short while ago documented that it has 29.77 million shares sold short, which is 2.68% of all regular shares that are obtainable for trading. Dependent on its buying and selling quantity, it would just take traders 1.5 times to go over their quick positions on typical.

Why Limited Fascination Issues

Limited desire is the quantity of shares that have been sold limited but have not but been included or shut out. Small providing is when a trader sells shares of a business they do not possess, with the hope that the rate will fall. Traders make income from shorter providing if the price of the stock falls and they get rid of if it rises.

Brief interest is vital to track simply because it can act as an indicator of market place sentiment in the direction of a specific inventory. An maximize in quick curiosity can sign that traders have become a lot more bearish, whilst a lessen in limited interest can signal they have turn out to be more bullish.

See Also: List of the most shorted stocks

Micron Know-how Quick Desire Graph (3 Months)

As you can see from the chart earlier mentioned the percentage of shares that are marketed limited for Micron Technological innovation has developed considering that its final report. This does not suggest that the inventory is likely to drop in the in the vicinity of-time period but traders really should be conscious that a lot more shares are currently being shorted.

Comparing Micron Technology’s Limited Curiosity Against Its Friends

Peer comparison is a well-known method amongst analysts and buyers for gauging how effectively a business is performing. A company’s peer is a further enterprise that has related qualities to it, these as market, sizing, age, and money structure. You can find a firm’s peer team by examining its 10-K, proxy filing, or by carrying out your have similarity analysis.

According to Benzinga Professional, Micron Technology’s peer group common for brief desire as a share of float is 3.60%, which suggests the enterprise has significantly less limited desire than most of its peers.

Did you know that raising limited desire can truly be bullish for a inventory? This put up by Benzinga Funds clarifies how you can financial gain from it..

This post was generated by Benzinga’s automatic information motor and was reviewed by an editor.