Micron Technology’s (NASDAQ:MU) brief % of float has fallen 14.35% because its previous report. The enterprise not long ago claimed that it has 21.25 million shares bought small, which is 1.91% of all standard shares that are obtainable for trading. Primarily based on its investing volume, it would get traders .9 days to protect their limited positions on regular.

Why Short Curiosity Matters

Brief curiosity is the number of shares that have been marketed small but have not nevertheless been protected or closed out. Shorter marketing is when a trader sells shares of a business they do not personal, with the hope that the selling price will fall. Traders make revenue from brief advertising if the price tag of the inventory falls and they reduce if it rises.

Shorter desire is crucial to monitor since it can act as an indicator of marketplace sentiment in direction of a specific inventory. An enhance in limited curiosity can signal that investors have turn out to be more bearish, when a lower in limited desire can sign they have come to be a lot more bullish.

See Also: Checklist of the most shorted stocks

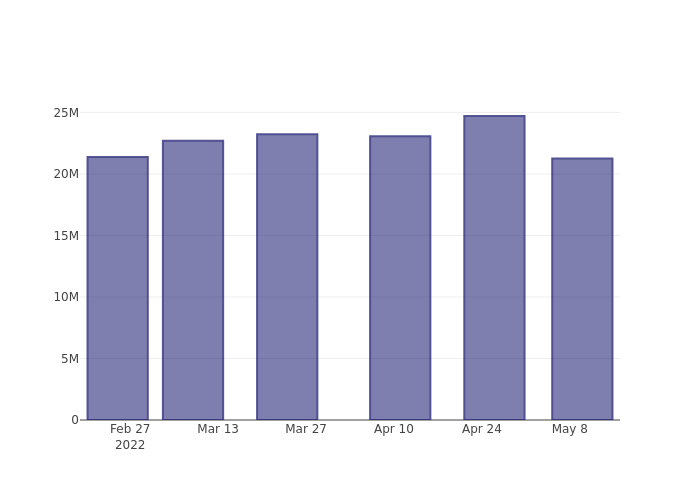

Micron Engineering Small Curiosity Graph (3 Months)

As you can see from the chart above the percentage of shares that are sold brief for Micron Technologies has declined because its last report. This does not signify that the inventory is likely to increase in the near-expression but traders must be knowledgeable that much less shares are being shorted.

Comparing Micron Technology’s Small Interest Towards Its Peers

Peer comparison is a preferred method among analysts and traders for gauging how very well a business is carrying out. A firm’s peer is another company that has comparable traits to it, this sort of as field, size, age, and economic framework. You can discover a firm’s peer group by studying its 10-K, proxy submitting, or by executing your very own similarity analysis.

In accordance to Benzinga Professional, Micron Technology’s peer team average for small fascination as a share of float is 2.50%, which usually means the business has a lot less quick fascination than most of its friends.

Did you know that growing brief fascination can essentially be bullish for a stock? This submit by Benzinga Funds explains how you can income from it..

This article was created by Benzinga’s automated information engine and was reviewed by an editor.

More Stories

SOLID Design Principles in C# with helpful examples

7 Reasons To Get A Forbrukslån & How To Get A Good One

8 Tips to Optimize Your SQL Queries for Improved Database Performance