Will Buying and selling in Micron Engineering Ever Settle Down?

Chip maker Micron Technology (MU) has viewed some major up and down swings in modern weeks in response to world occasions and analyst actions. Let’ verify out the charts to see if we may well see calmer action in the foreseeable future.

In this each day bar chart of MU, under, we can see a quantity of speedy up and down swings more than the earlier a number of months. Buy and maintain buyers have almost certainly had some sleepless evenings and even selection traders have probably been challenged. Charges are down below the declining 50-working day shifting ordinary line but are screening the underside of the flat 200-day relocating common line.

The On-Stability-Quantity (OBV) has slowly but surely turned lower from the middle of February telling us that traders have develop into extra aggressive sellers. The Shifting Common Convergence Divergence (MACD) oscillator is bearish.

In this weekly Japanese candlestick chart of MU, below, we can see the previous 3 several years of value motion. The all round perception I get from this chart is the blended character of the alerts. Charges have traded sideways for a lot more than a calendar year. MU is underneath the 40-week moving ordinary line. The most recent candle could move for a hammer bottom pattern but I would not take into account it a good instance as the decreased shadow could be for a longer period.

The weekly OBV line has been weakish considering that previous March. The MACD oscillator produced a lessen significant this calendar year compared to past year even nevertheless charges designed a slightly higher superior. This is a considerable bearish divergence. The oscillator is pointed down and near the zero line.

In this daily Point and Determine chart of MU, beneath, we can see a prospective draw back rate target of $54.

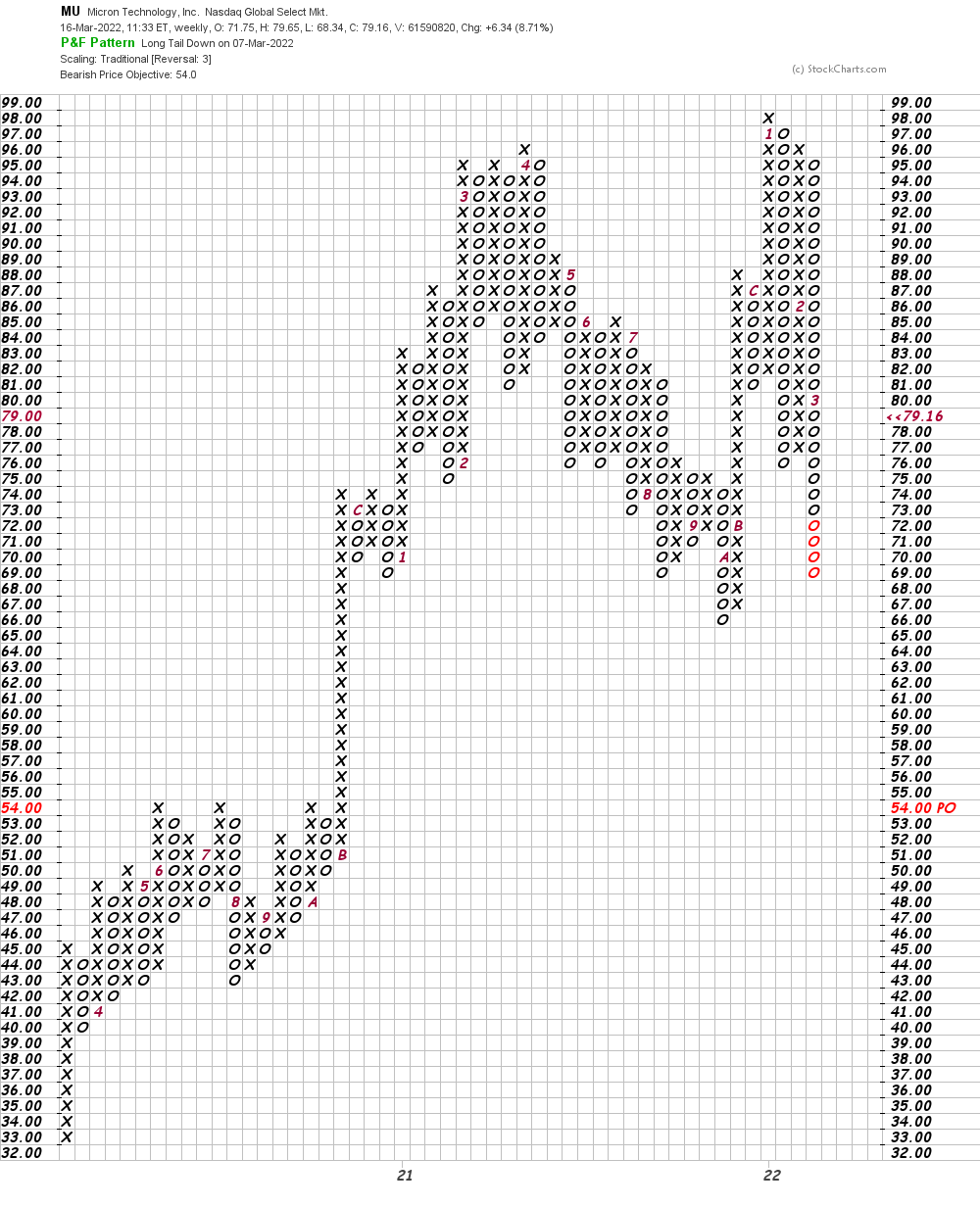

In this next Level and Figure chart of MU, under, we employed weekly value facts and in this article the chart also yields a $54 price target.

Bottom line tactic: In the limited-operate, investing in MU could remain unsettled. The important location I am looking at is the Oct reduced – hopefully charges can rebase previously mentioned it.

Get an email inform every single time I compose an report for Authentic Revenue. Click the “+Comply with” upcoming to my byline to this report.