vzphotos/iStock Editorial by way of Getty Images

Introduction:

With the existing industry downturn, we see a golden prospect to acquire into the semiconductor marketplace by way of memory giant: Micron Know-how (NASDAQ:MU). The advocacy close to the strong obtain on Micron is twofold and straightforward. Very first, Micron operates on memory for the duration of an period when the memory market’s development is a truth and necessity. The pandemic was the cure to Micron’s stagnation. It greater memory infrastructural demands to assistance get the job done from residence environments, and these requires are continue to on the rise. Worldwide memory chip markets are forecasted to increase at a 16% CAGR by 2024. Micron will be an essential portion of that growth. The 2nd layer driving the strong obtain is selling price. Micron is affordable for what it truly is featuring. The business has outpaced earnings and gross margin consensus for the past 6 quarters.

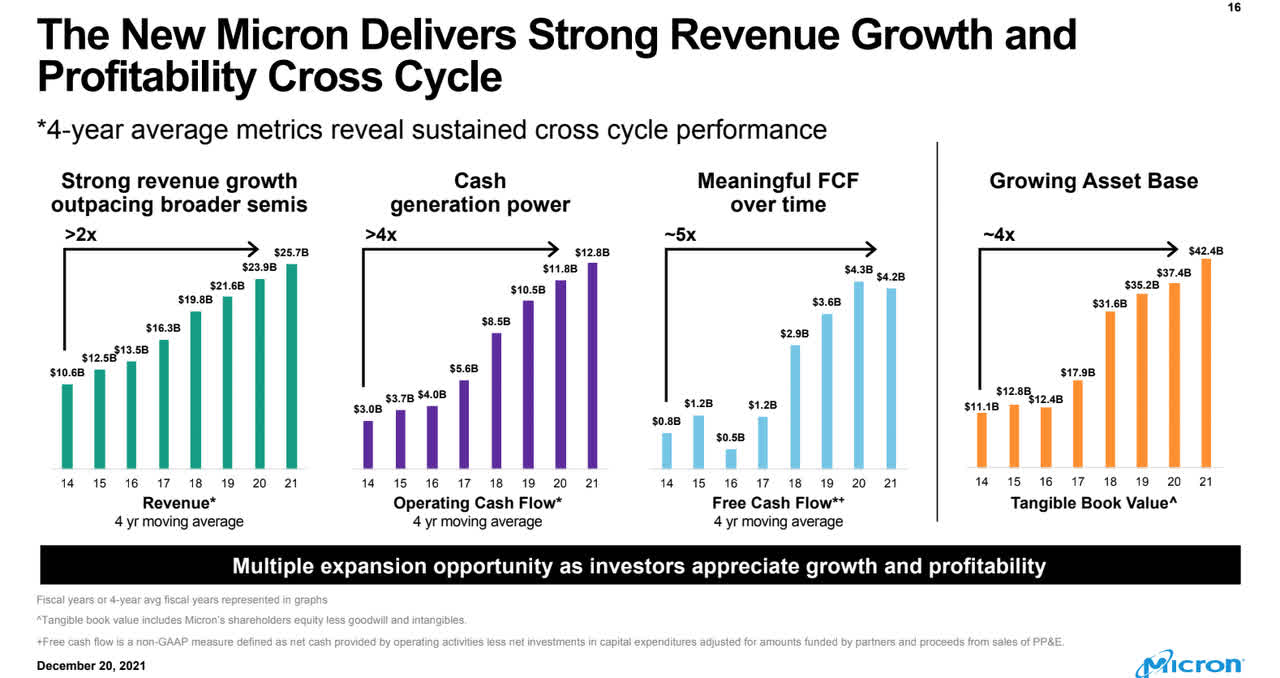

Essentially, Micron’s earnings elevated from $5.8b in Q1 ’21 to $8.3b in Q2 ’21. Micron’s FY21 earnings exhibit expansion of 29% YoY. MU’s competitive edge in the industry market is not its figures but its target on memory that fuels its price expansion and quarterly adjust.

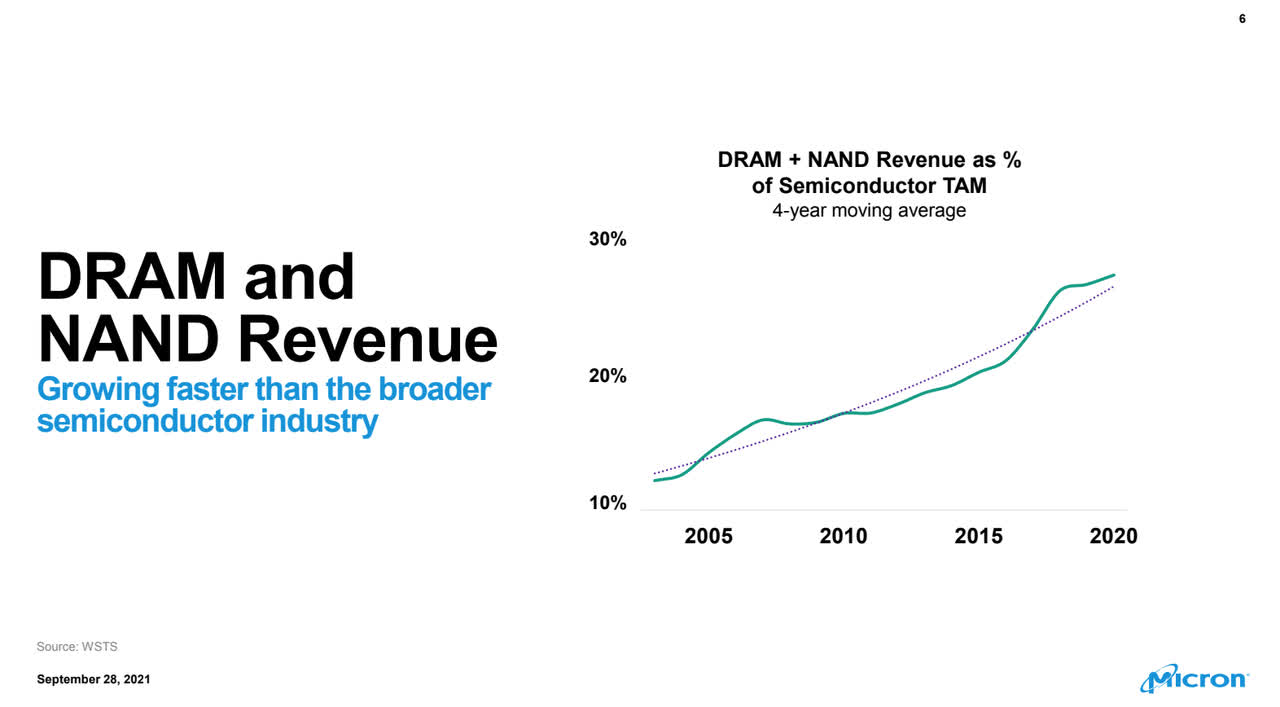

Micron’s continuous growth occurs in just the memory sector market that splits into two main productions: unstable (usually, DRAM) and non-unstable (NAND). The previous manages your knowledge whilst the latter retailers it. Adhering to the exact sample, Micron’s production is divided involving DRAM, generating up roughly 72% of its income and NAND filling in the remaining 23% with seasonal fluctuations. The most important marketplaces Micron provides are PCs, Mobiles, Servers, and the biggest on-demand from customers Knowledge Centers. Micron has executed a product or service transition to the newest technological innovation: 1-alpha nodes in DRAM and 176 layer 3D NAND. We imagine Micron’s price reduction will outpace the field decline pushed by the changeover to 1-alpha and 176-layer 3D. Micron’s solution transition will make it exceedingly financially rewarding. Now is the time to acquire-in.

Micron

Micron is not the initial but amongst the premier DRAM and NAND producers globally after Samsung (OTC:SSNLF) and SK Hynix. The catch is that Micron is a pure memory organization even though its rivals are not. Memory is only 25% of Samsung’s revenues, and SK Hynix focuses on memory along with foundry enterprises. Micron is dedicated to the memory league– it is a important supplier, so its inventory are unable to dip much too low with no heading again up, precisely with improved need for DRAM and the growth of Facts Middle close markets.

Stock Functionality:

Micron’s inventory has dropped 22.76% since very last calendar year. The Yr-to-Day (YTD) affirms a lot more of the exact, with a fall of 24.11%. However, the corporation managed their stock value amongst a $65.67 reduced and a $98.45 large.

Micron has developed significantly on its five-12 months metric by 154.77%, extra than its competition, with SK Hynix at 127.9% and Samsung Electronics at 61.83%. Micron is a pandemic-favored inventory. We noticed it enhance gross margin scores over the past 8 quarters. We nevertheless did witness the stock decrease at the start out of 2022, but it is gradually recovering.

Micron

Valuation:

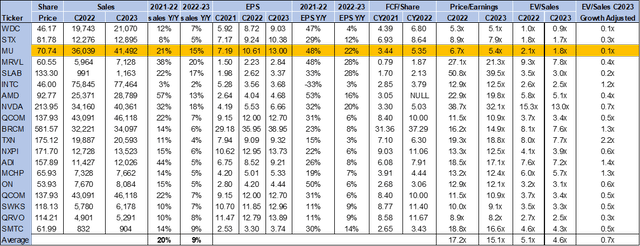

Micron is a worth choose and a long-phrase progress decide on in the semiconductor memory current market. MU’s inventory is at this time gaining momentum at $72.66, again up from its 52-7 days reduced of $65.67. EPS estimates for 2022 stand at $10.61 and $13.00 for 2023, which are among the the optimum in the business. We consider these numbers all point to Micron’s possible development inventory. MU came out of FY2021 gross sales with 21% and outperformed the regular Y/Y gross sales of 20%. When MU’s FY2023 anticipations are reduced at 15%, they still outweigh the group average for the very same period of time, at 9%. Even with all this, the inventory is nonetheless investing extremely cheaply.

On the EV/Profits metric, MU is buying and selling at 2.2x when compared to its much larger-cap group average of 5.5x and is forecasted to trade at a decrease price of 1.9x in C2023 with the group typical of 5.0x. We consider it’s simple that Micron is undervalued, buying and selling at 7.6 instances ahead earnings estimates. The corporation by now outperformed Wall Road consensus on income and EPS. If MU proceeds increasing beyond what analysts have pegged for, it will surpass 2022 estimates.

Refinitiv

Term on Wall Road:

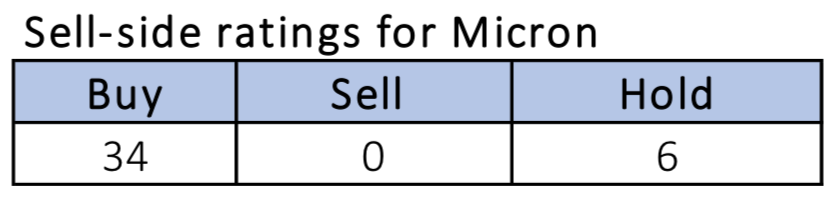

Sector consensus for Micron is an clear get, with the obtain vote earning up 90% of the sell-aspect rankings and a 10% opting for a maintain. The market is optimistic about Micron’s upside as of the 40 votes pushed for a promote regardless of ongoing source chain pressures.

Refinitiv Refinitiv

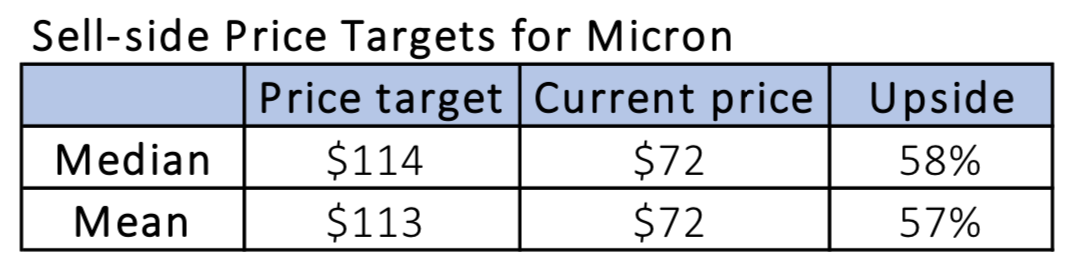

Micron’s upside is further affirmed in its offer-facet price tag targets, with the median price focus on standing at $114 and the latest selling price at $72, leaving room for a 58% upside. The suggest cost focus on stands at a similar $113 and foretells a probable 57% upside. Micron’s price tag targets illustrate how undervalued the inventory is now, which results in being even extra apparent, viewing how significant the stock costs of other semi players are in comparison.

What to do with the inventory:

We look at Micron as a definite invest in. Even even though the industry seems to be significantly less than suitable, it has opened the cookie-cutter entry place into an growing marketplace. Micron underperformed both equally the PHLX Semiconductor and S&P 500 indexes as the next chart displays.

YCharts

There keep on being fears about the modern promote-off, but they are reassured by the reality that semiconductor stock investing takes place in the sector as a total rather than individual stocks. The promote-off is uniform to the marketplace and not particular to Micron. The value drop in fact is effective in investors’ favor. Micron’s stock is inexpensive thanks to marketplace volatility and simultaneously extremely undervalued in distinction to its likely. As a result, presented the risk/reward, we would be acquiring shares listed here.

More Stories

SOLID Design Principles in C# with helpful examples

7 Reasons To Get A Forbrukslån & How To Get A Good One

8 Tips to Optimize Your SQL Queries for Improved Database Performance