This short article originally appeared on Merely Wall St Information.

Very last 7 days Micron Engineering ( NASDAQ:MU ) launched next quarter outcomes. The benefits were being comfortably ahead of forecasts, and advice for the 3rd quarter was lifted. Immediately after at first gaining 4.7%, the share value tracked the sector lower.

Micron has pretty very low expectations priced into its current valuation. At the same time, data centre desire appears to be much better than anticipated , and if that continues anticipations could enhance meaningfully.

Next quarter effects at a look:

-

EPS: $2.14, up 118% calendar year on calendar year and 16 cents in advance of consensus estimates.

-

GAAP EPS: $2.00, up 277% year on 12 months and 16 cents forward of consensus estimates.

-

Income: $7.78 bln, up 24.8% yr on year and $244 mln superior than expected.

-

Demand from customers and price ranges for NAND and DRAM memory chips keep on to rise.

-

Details middle need for memory and storage is anticipated to outpace broader marketplaces above subsequent 10 years.

-

3rd quarter steerage: Revenue estimate lifted from $8.1 bln to ~$8.7 bln and EPS from $2.21 to ~$2.33.

Micron’s around-phrase outlook has improved, whilst it is unlikely to match the previous quarter’s earnings growth. But what genuinely matters for buyers is the expectations that are at present priced into the stock and how they may possibly change in excess of time.

How does Micron Measure up towards the Tech Sector and Semiconductor Marketplace?

If you seem at the Simply Wall St Markets site , you can see the price-to-earnings ratio and forecast earnings growth premiums for each sector, and for just about every industry inside of each sector.

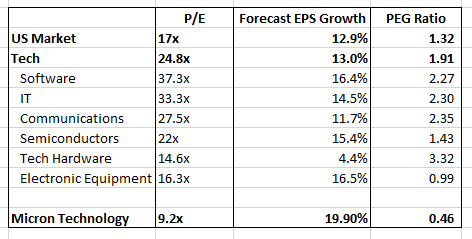

We can see that the regular P/E ratio for semiconductor shares is 22x, which is the third least expensive among the 6 industries, and substantially reduce than the software package sector which is at 37.3x.

When we glance at forecast expansion costs, the semiconductor field is anticipated to mature at 15.4%, which is only marginally decreased than the software and digital gear industries.

We can also merge the P/E ratio and progress forecast by calculating a ‘PEG’ (P/E to Development) ratio. By dividing the P/E ratio by the anticipated progress fee we get there at values that are a lot easier to look at . We can insert Micron to the list two to see how it compares to the current market, the tech sector, and the semiconductor field.

The existing PEG ratios counsel that the semiconductor business is more favorably valued relative to expansion expectations than all the tech industries apart from digital products. This doesn’t suggest semiconductor stocks will carry out far better, but that anticipations relative to forecasts are at this time lower.

Micron Technology’s P/E and PEG advise expectations are even reduced. The recent forecast EPS expansion price for the up coming number of years is 19.9%. Even though EPS improved by 182% above the very last 12 months, analysts are expecting a sharp slowdown in the upcoming couple decades.

Need and prices for memory and storage chips is cyclical, so revenues are usually lumpy. In fact it is hard to forecast desire a lot more than a 12 months or two in advance, so analyst estimates are understandably conservative – and their forecasts are probably to transform. The great information for investors is that these forecasts are very low, and the recent P/E is reduced relative to these forecasts.

What does this suggest for traders?

The base line below is that Micron is at present looking at sturdy need for its goods, even though the market’s expectations for the foreseeable future are lower. This contrasts with a large amount of other technology stocks that have optimistic forecasts and even more optimistic valuations. This suggests draw back for Micron could be confined, while there is prospective for considerable upside if the more time-term outlook enhances.

To study far more about the corporation, have a seem at our hottest analysis for Micron Technologies . You can use the Just Wall St Screener to obtain other semiconductor stocks with robust fundamentals.

Have feedback on this post? Concerned about the content? Get in contact with us right. Alternatively, electronic mail [email protected]

Basically Wall St analyst Richard Bowman and Only Wall St have no position in any of the providers talked about. This posting is common in nature. We provide commentary centered on historic details and analyst forecasts only using an impartial methodology and our content articles are not supposed to be financial information. It does not represent a recommendation to buy or market any inventory and does not consider account of your targets, or your fiscal problem. We goal to convey you lengthy-time period concentrated investigation pushed by fundamental knowledge. Be aware that our assessment may possibly not issue in the newest cost-delicate corporation bulletins or qualitative product.

More Stories

SOLID Design Principles in C# with helpful examples

7 Reasons To Get A Forbrukslån & How To Get A Good One

8 Tips to Optimize Your SQL Queries for Improved Database Performance